Wire Transfer Fraud. It’s an epidemic that’s rising at an alarming rate – in fact, in 2016, the FBI indicated that the number of reported events in 2016 from title companies rose an astonishing 480-percent.

The simple truth is this: =even if you think you’ve crossed every ‘t’ and dotted every ‘i’, there’s a good chance that those who are a bit ‘seedier’ among us have anticipated those actions. They monitor the emails and the communication traffic long enough to ensure that whomever they are reaching out to won’t be alarmed (or even notice) any changes in the emails they’re receiving.

For example – if you’re emailing from TitleJoe@company.com, with a very specific email format – someone MAY receive an email from TitleJoe@company.NET with an identical email format, with wire instruction changes – in an embedded link so as to not alert anyone to changes in URLs – and all will seem well.

When in fact, all is NOT well, and someone has just lost their life savings. The fact is, these cyberattacks are frightening and on the rise – and the only way to protect yourself, your company, and your clients is to initiate secure, consistent protocols that can help everyone be sure that any money being transferred is received by the right party – not someone who merely appears to be the right part.

*Sutherland Title claims no responsibility in regards to any fraud initiated against your company, and is merely providing these safeguards in an attempt to help you implement ideas to secure your wire transfer protocols.

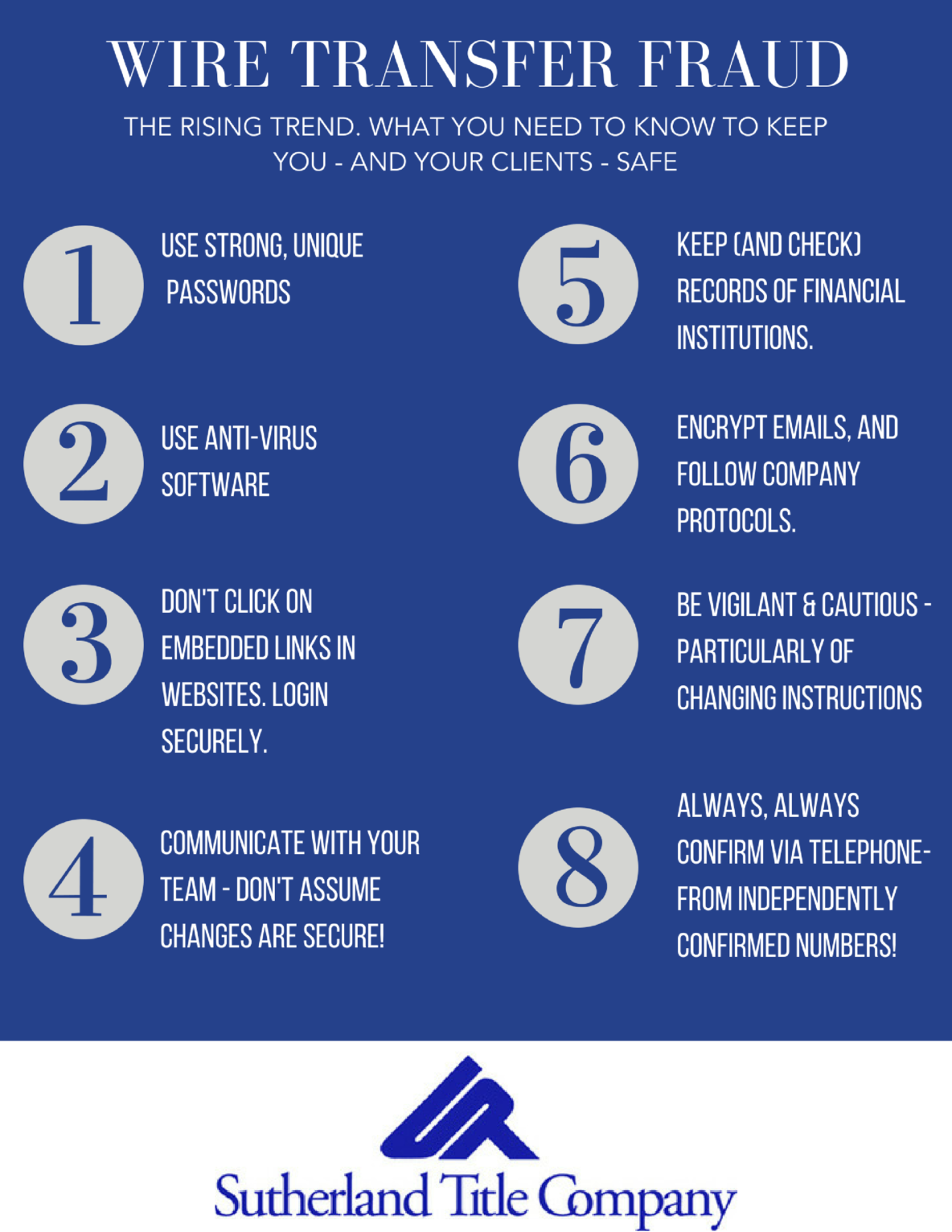

1. Use strong, unique passwords.

Be sure that any passwords utilized by any member of your staff are unique to that platform and that individual: ensure that no passwords are duplicated.

2. Use anti-virus software.

Ensure that any computer utilized for company-correspondence or wire-transfers be running up to date anti-virus software.

3. Don’t click on embedded links in websites – login securely.

Ensure that every member of your staff recognizes the importances of visiting any wire-transfer sites or programs independent of any links received in emails or correspondence. Always visit the site organically and log in specifically with your individual login credentials.

4. Communicate with your team -don’t assume changes are secure!

Just because an email appears to come from Joe Title doesn’t mean it necessarily comes from Joe Title. If any changes have been initiated via email, be sure to verify in person.

5. Keep (and check!) records of financial institutions.

Be sure that any wire transfer instructions are utilizing financial institutions that you have record of.

6. Encrypt emails and follow company protocols.

Ensure that every email you’re sending, particularly those with wire-transfer instructions, are following specific company protocols and are being sent securely.

7. Be vigilant and cautious – particularly of chang

ing instructions.

It never hurts to double-check. If instructions have changed, or things don’t look or feel right, trust your gut. You’ll be glad you checked.

8. Always, always confirm via telephone – from independently confirmed phone numbers.

When verifying wire transfer instructions, ensure that you check via telephone – and not the numbers listed in the emails. Make sure you utilize the numbers that have been verified in your company financial records.

Remember: It’s always better to be safe than sorry!

*Sutherland Title claims no responsibility in regards to any fraud initiated against your company, and is merely providing these safeguards in an attempt to help you implement ideas to secure your wire transfer protocols.